DOL's Final Rule Increases Minimum Salary Threshold for FLSA Exemption, Overtime Requirements

On April 23, 2024, the Department of Labor (DOL) announced its anticipated final rule increasing the minimum salary threshold for exemption to the Fair Labor Standards Act (FLSA) overtime requirements, effective July 1, 2024. The FLSA requires covered employers to pay employees a minimum wage and, for employees who work more than 40 hours in a week, overtime premium pay of at least 1.5 times the employee’s regular rate of pay. However, the FLSA exempts from its minimum wage and overtime requirements “any employee employed in a bona fide executive, administrative, or professional capacity[.]” Generally speaking, in order to meet this executive, administrative, or professional (EAP) exemption:

- The employee must be paid a predetermined and fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed (the salary basis test).

- The amount of salary paid must meet a minimum specified amount (the salary level test).

- The employee’s job duties must primarily involve EAP duties as defined by the regulations (the duties test).

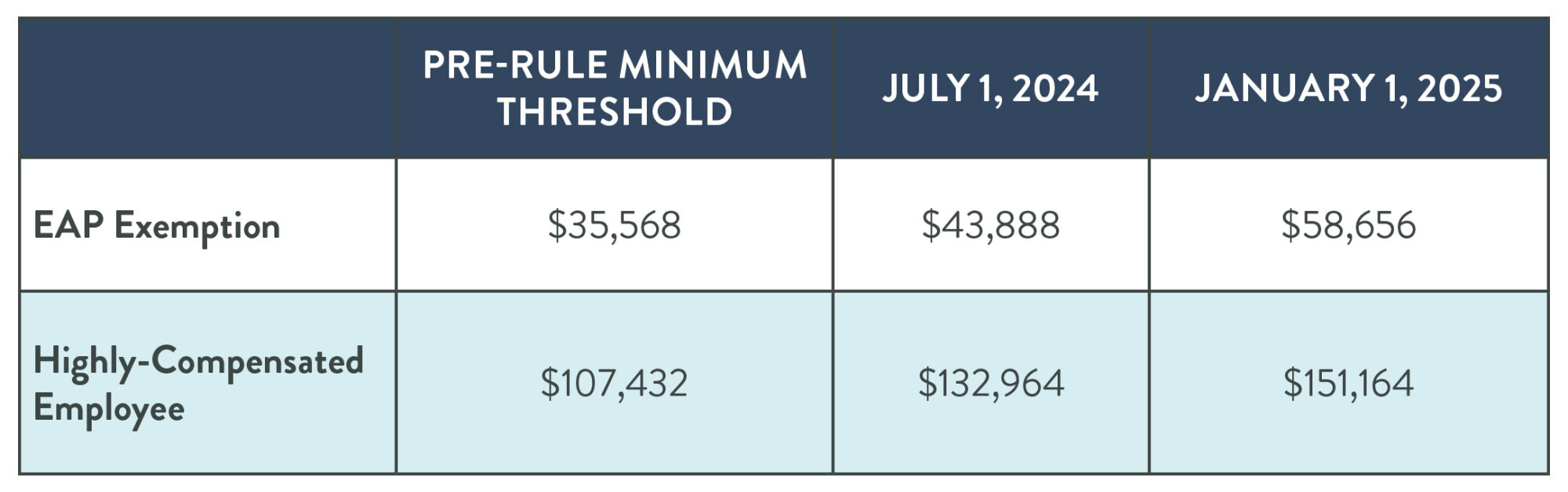

The DOL’s newly-announced final rule impacts the salary level test for the EAP exemption. The present annual salary threshold for the EAP exemption is $35,568. Under the new rule, the minimum salary threshold will increase to the equivalent of an annual salary of $43,888 on July 1, 2024, and increase to $58,656 on Jan. 1, 2025. Additionally, the new rule will adjust the salary threshold for highly-compensated employees. Specifically, the regulations contain a special rule for highly-compensated employees, and under the new rule, the total annual compensation requirement for the highly-compensated employee exemption will raise from $107,432 to $132,964 on July 1, 2024, and to $151,164 on January 1, 2025. Finally, the rule provides that the salary thresholds will update every three years by applying up-to-date wage data to determine new salary levels, with the first update scheduled for July 1, 2027.

The rule will undoubtedly face legal challenges, and implementation of the rule may be stalled by legal challenges or by a change in presidential administration. This rule is not the first attempt to increase the minimum salary threshold for the EAP exemption, as the DOL issued a similar rule in 2016 that was stayed due to legal challenges and ultimately modified with the change in presidential administrations. In addition to arguments made in the 2016 lawsuits, challengers of the new rule can point to U.S. Supreme Court Justice Kavanaugh’s dissent in the 2023 Helix Energy Solutions Group, Inc. v. Hewitt decision, where he questioned whether regulations regarding how much an employee is paid could survive a challenge that they are inconsistent with the FLSA. This, in addition to recent challenges to deference given to administrative agencies in Loper Bright Enterprises v. Raimondo, suggests that the new rule may be stayed or modified before it goes into effect.

While this is the case, employers should prepare as if the DOL's final rule will remain effective, with minimum salary thresholds set to increase for the first time on July 1, 2024. Employers should take stock of their exempt workforce in order to evaluate which employees currently qualify as exempt under the EAP exemption, and which employees or job positions may be impacted by the impending changes to the minimum salary threshold.

Stinson attorneys will be closely following these developments. For more information regarding the DOL’s final rule and its impact on your exempt employees, please contact Amy Conway, Carrie Francis, Molly Keppler, Stephanie Scheck, Luke VanFleteren, Benjamin Woodard or the Stinson LLP attorney with whom you regularly work.